10 of the Worst Ever Accounting Scandals

There’s something darkly fascinating about huge corporate frauds. Not just the immorality and audacity of the powerful perpetrators, but also the fact that they so often go unnoticed—or unreported—for years on end.

So let’s look at ten of the most shocking accounting scandals of modern times, from the Bernie Madoff Ponzi scheme to the Lehman Brothers fraud that helped kickstart a global financial crisis. Strap in and get ready—it’s quite a ride!

Enron

Enron, a US energy company once lauded for its “miraculous” growth, was exposed in 2001 for hiding billions in debt and inflating earnings.

An SEC investigation found CEO Jeff Skillings and former CEO Ken Lay had manipulated the company's financials and pressured its auditing firm, Arthur Andersen, into turning a blind eye.

While Lay died before imprisonment, Skillings received a 24-year prison sentence for his role in this giant fraud.

The scandal led Enron's share price to plummet from $90 to under $1 within a year, with shareholders losing over $74 billion. Enron filed for bankruptcy and Arthur Andersen was forced to dissolve, causing tens of thousands of job losses.

Tyco

In 2002, Dennis Kozlowski and Mark Swartz–the CEO and CFO of major US security systems company Tyco–were discovered to have embezzled over $150 million and overstated its earnings by $500 million.

Garish details emerged about the outrageous ways these embezzled funds had been used. This included an extravagant $2 million birthday party for Koslowski’s wife, which became known as “The Tyco Roman Orgy”.

Both Kozlowski and Swartz were sentenced to 25 years in prison, and a resulting class-action lawsuit forced Tyco to repay investors $2.92 billion.

WorldCom

In 2002, WorldCom—a major American telecommunications company—was exposed for exaggerating its assets by nearly $11 billion, one of the biggest overstatements of this kind in history.

The company had fraudulently categorized expenses as capital costs and recorded fake revenue.

When Worldcom internal auditor Cynthia Cooper discovered these fake entries–which added up to $3.8 billion–she blew the whistle and the fraud became public knowledge.

CEO Bernie Ebbers was sentenced to 25 years for fraud, conspiracy, and falsifying documents. The scandal led to the loss of over 30,000 jobs and a staggering $180 billion in losses for investors.

Freddie Mac

In 2003, an investigation by the SEC into Freddie Mac, a major government-backed lender in the US, revealed that they had misstated their earnings by $5 billion.

Key executives, including CEO Leland Brendsel, COO David Glenn, and CFO Vaughn Clarke, were found to have been complicit. Consequently, Freddie Mac was slapped with a $125 million fine, and its senior leadership got fired.

Unfortunately, this scandal didn’t end up forcing Freddie Mac to truly mend its ways. Its incompetence and mismanagement of risk relating to subprime mortgages became a major cause of the 2008 financial crisis.

Lehman Brothers

Top-tier US investment bank Lehman Brothers concealed over $50 billion in loans, masquerading them as sales through accounting trickery.

An SEC probe revealed that Lehman temporarily offloaded toxic assets to Cayman Islands banks, only to repurchase them later. This tactic misleadingly projected the company as having $50 billion more in cash than it really did.

This fraud partly caused Lehman Brothers' eventual bankruptcy, which in turn played a key role in causing the 2008 financial crisis.

Bernie Madoff

Bernie Madoff, an American stockbroker, masterminded the biggest Ponzi scheme in history, defrauding investors of $64.8 billion.

In a Ponzi scheme, early investors are paid returns using the capital of newer investors, not actual profits. As the 2008 recession hit and investment in his fund decreased, Madoff couldn't meet requests to withdraw capital from it, causing the entire house of cards to come tumbling down. This fraud finally ended with his sons reporting him to the authorities.

Convicted of fraud, money laundering, and related offenses, Madoff was sentenced to 150 years in federal prison. His victims included some very wealthy individuals–such as Swiss aristocrat Rene-Thierry Magon de la Villehuchet, who committed suicide after losing everything–as well as many ordinary, middle-class people.

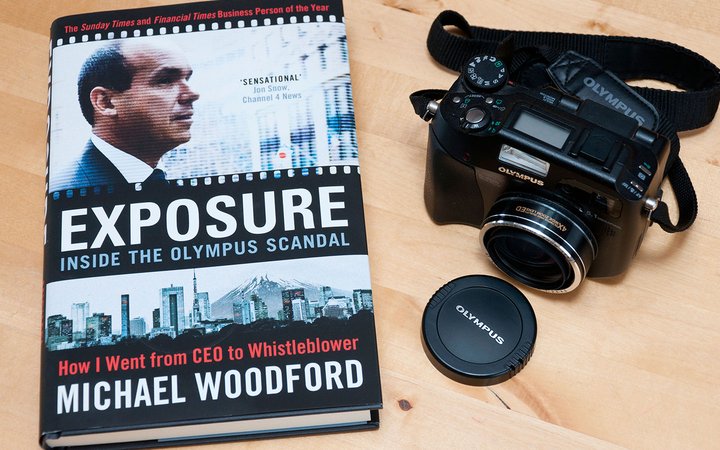

Olympus

In late 2011, a staggering $1.7bn fraud at camera manufacturer Olympus was exposed by its British chief executive, Michael Woodford. In a surreal turn of events, they then fired him for blowing the whistle.

Investigations revealed that the company's prior management had concealed losses for 20 years. Reportedly, the Yakuza (Japanese organized crime) may even have been involved.

Former chairman Tsuyoshi Kikukawa and two other executives were handed suspended jail terms for their roles in the scandal, while an adviser to Olympus received a four-year prison sentence.

Toshiba

Japanese technology giant Toshiba overstated its profits by $1.2 billion, forcing its CEO to resign. This deception involved recording profits early, delaying losses, and postponing expenses.

Toshiba's culture, which was very hierarchical, provided the perfect environment for these mispractices to take place.

While top executives didn’t directly ask for false reporting, their intense pressure to hit unrealistic financial goals pushed employees to manipulate figures in order to appease them and keep their jobs.

Wirecard

Wirecard was a major German fintech company that fabricated almost $2 billion in revenue, amounting to the biggest accounting scandal in the country’s history.

The fraud was initially exposed by FT journalists, and in June 2020, auditing company EY refused to greenlight Wirecard's financial report. Not long after, Wirecard filed for insolvency. Its CEO, Markus Braun, is still on trial and facing up to 15 years in prison if found guilty.

Wirecard's downfall was an embarrassment for Germany's regulators and political institutions, as red flags had been visible for years. It also damaged Germany's reputation as a fintech hub.

FTX

Last but not least is a very modern scandal, involving former wunderkind Sam Bankman-Fried, the founder and CEO of the FTX crypto exchange platform. He was recently found guilty of engaging in a massive scam after the platform collapsed in 2022.

Bankman-Fried has yet to be sentenced but is facing up to 110 years in prison for mismanaging customer funds, using them to fund lavish personal expenses, failing to provide accurate financial information to investors, using FTX funds to prop up his hedge fund Alameda Research, and engaging in market manipulation.

With $8 billion in customer assets missing, the FTX scandal has significantly damaged the reputation of the crypto industry and led to increased scrutiny from regulators.

Final thoughts: will accounting scandals keep happening?

What accounting scandals look like has changed over time, from the Wall Street corruption of the 2000s to the very modern phenomenon of crypto scams.

But despite this, and that many governments and companies have taken steps to improve corporate governance and oversight, history seems to repeat itself.

Whether driven by greed or the pressures of hitting unrealistic financial goals, when there's a will to bend the rules, there's often still a way.

In most likelihood, accounting scandals will continue happening in any industry where there isn’t a culture of transparency and ethics. As we've seen, stricter regulation isn’t enough; true change requires a deeper shift away from a focus on profits and growth at all costs.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store