A Brief History of VAT

VAT: it’s that little extra tacked onto the price tags of almost all the items we buy. Everywhere yet often unnoticed, it’s become a pillar of modern tax systems.

What you might be surprised to hear is that it wasn’t always like this. In the last 70 years, VAT has gone from an obscure idea to a crucial source of tax revenue in over 160 countries.

Read on to find out how VAT was invented, why it spread so rapidly around the world, and the controversies that it managed to generate along the way.

What exactly is VAT?

Value-added tax (VAT) is levied on the value added at each stage of the production and distribution of goods and services.

Companies can pass their VAT burden along to the next company in the production cycle. This means the end consumer is the one who ultimately pays the tax, which is collected for the government by the business selling the product or service.

VAT is typically shown as a percentage of the final price, and applies to most goods and services, with only a few categories exempted.

The origins of VAT

The concept of VAT can be traced back to two key intellectual pioneers in the early 20th century who wanted to make their tax systems more efficient and fairer.

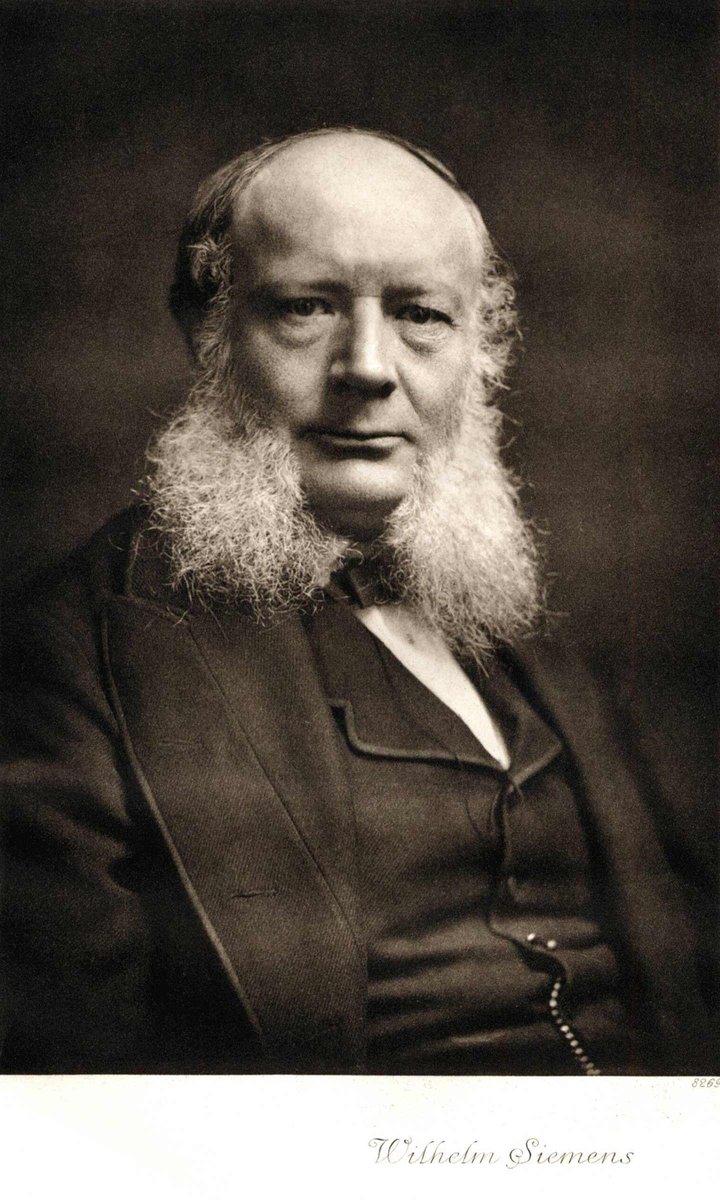

Wilhelm von Siemens, a German industrialist, proposed the VAT system as a way to resolve the country’s problem of “cascading taxes”. This is where separate taxes at each stage of production and distribution distort the market and lead to higher prices for consumers.

Thomas S. Adams, an American economist and policymaker, advocated VAT to the U.S. Congress in the 1920s. He argued it would be a more efficient and fairer way to raise revenue. However, his proposal was rejected by populist politicians.

Ultimately, it wasn’t until April 10, 1954, that a country introduced a truly modern system of VAT. This happened in France, under President René Coty, with tax official Maurice Lauré generally being credited with devising and implementing their VAT system.

As VAT replaced a complex tax on production, it simplified France’s tax system.

VAT was also designed to be fairer than previous taxes, which were often criticized for creating loopholes and unfairly favoring the rich.

Some critics at the time even went as far as to describe the French tax system as the “vampiric state”.

The spread of VAT in the EU and beyond

Other European countries soon followed France's lead and implemented their own VAT systems. By the end of the 1970s, VAT had become a common tax in many European countries.

A key reason for VAT spreading so quickly is that it became central to the efforts of the EEC (now the EU) to harmonize trade between member states. The EEC officially adopted the VAT system in 1977 and made it a requirement for joining, encouraging many European countries to do so. Today, member states must have a VAT rate of at least 15% (although a few jurisdictions like the Canary Islands are exempt).

VAT also spread rapidly beyond the EU from the 1970s onwards. By 1989, 48 countries—mainly in Western Europe and Latin America, but also some developing countries—had adopted a VAT system.

VAT’s world conquest has only sped up since, thanks in part to being strongly advocated by the International Monetary Fund (IMF). It is now used by over 170 countries worldwide.

Interestingly, however, most non-EU countries have lower VAT rates than the average EU country. For example, the standard rate in Switzerland is 7.7%, and 10% in South Korea.

Controversies around VAT

As with all forms of taxation, there’s a longstanding debate about whether VAT is efficient and fair.

Many economists argue VAT is a relatively efficient way to raise vital public funds, with studies like this one showing that it harms growth less than income and corporate taxes. Proponents also say that it is simpler and easier to comply with than traditional sales taxes.

However, critics argue VAT poses an enormous burden for businesses and that it is a form of double taxation, as most countries that use the system also tax income. They also argue that by increasing the price of almost all consumer goods, VAT hits those on lower incomes disproportionately hard.

In response to such criticisms, the EU and others have reformed and streamlined their VAT systems over the years. However, as VAT rates also increased in most Western countries over the years, its critics are unlikely to be appeased.

The future of VAT

Despite these controversies, there’s little question that VAT is here to stay.

From its humble beginnings as an overlooked idea for simplifying consumer taxes, it now accounts for an average of around 20% of total tax revenues across the OECD. This makes it a vital source of cash for the many increasingly indebted countries out there.

So while governments will continue to reform and streamline their VAT systems, it’s unlikely to be replaced during our lifetime.

VAT-compliant invoicing with Sufio

If you want to make sure that your Shopify store complies with VAT laws, Sufio could be the solution for you.

Our invoicing app automatically creates documents compliant in over 50 countries, charging the correct level of VAT for each customer’s country.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store